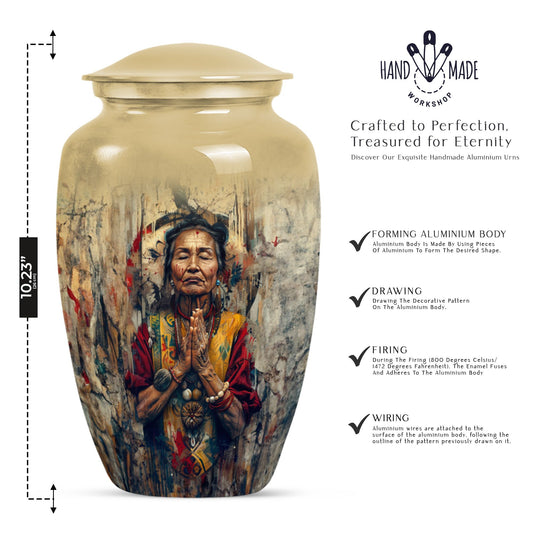

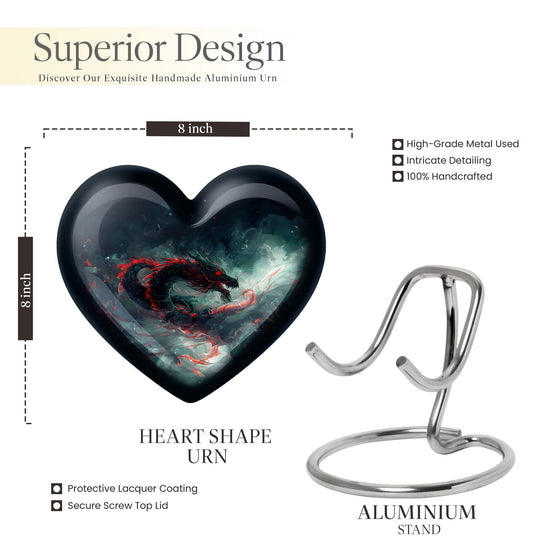

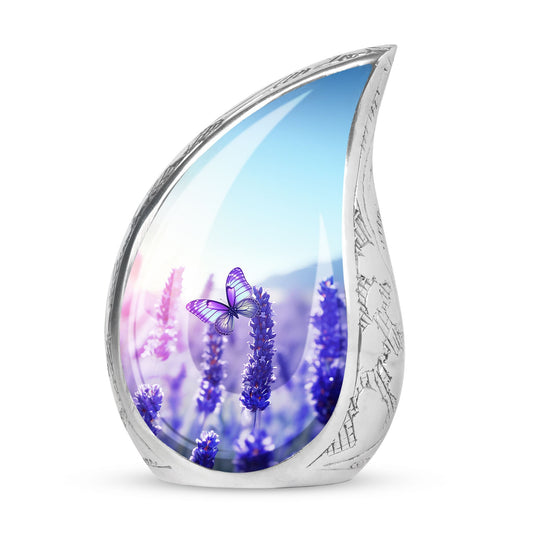

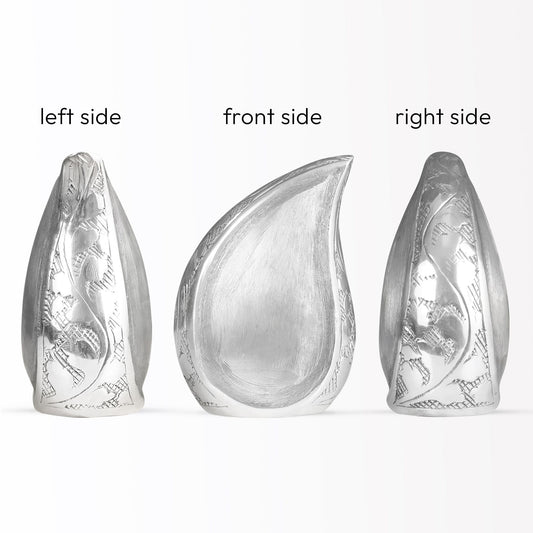

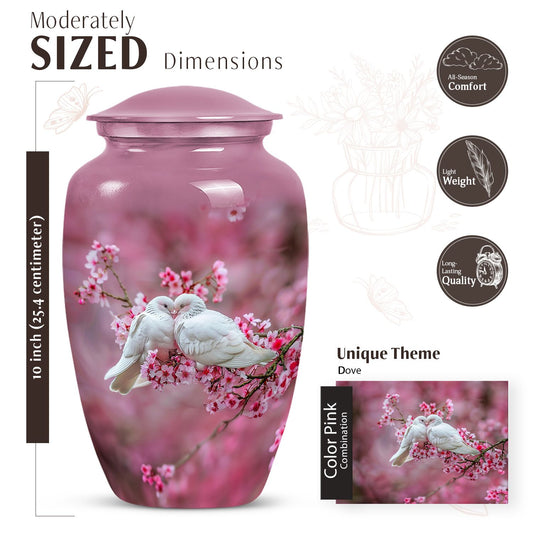

Popular Urns

Managing a Deceased Family Member’s Finances | Financial Checklist

Losing a loved one is emotionally overwhelming, and dealing with their financial matters can feel daunting. However, handling their finances properly is essential to avoid legal complications and ensure a smooth transition of assets. This guide will walk you through the crucial steps of managing your loved one’s finances, including legal obligations, settling debts, and transferring assets.

1. Obtain the Death Certificate

The first step in managing financial matters is to obtain multiple copies of the death certificate. Financial institutions, government agencies, and insurance companies will require this document to process claims and account closures.

Where to Get a Death Certificate?

-

Local vital records office

-

Hospital or healthcare provider

-

Funeral home that handled the arrangements

2. Locate and Secure Important Financial Documents

Gather all essential financial documents, including:

-

Will or trust documents

-

Life insurance policies

-

Bank account statements

-

Investment and retirement account details

-

Mortgage and loan agreements

-

Credit card statements

-

Tax records

3. Notify Financial Institutions and Government Agencies

Informing the necessary agencies will help prevent identity theft and unauthorized transactions.

Who to Notify?

-

Banks and Credit Unions: Close or transfer accounts as needed.

-

Credit Bureaus: Request a credit freeze to prevent fraud.

-

Social Security Administration: If your loved one was receiving Social Security benefits, notify SSA immediately to stop payments.

-

Employers & Pension Providers: If applicable, inform their employer to settle unpaid wages and benefits.

-

Insurance Companies: File claims for life insurance and other relevant policies.

4. Settle Any Outstanding Debts and Bills

Outstanding debts do not disappear after death. The estate is responsible for settling these obligations.

Steps to Handle Debts:

-

Identify all outstanding debts, including mortgages, loans, and credit card balances.

-

Contact creditors and provide a copy of the death certificate.

-

Consult an attorney if there is uncertainty about debt responsibility.

-

If the estate does not have sufficient funds, prioritize secured debts like mortgages over unsecured ones.

5. Handle Estate Administration and Probate

If your loved one left a will, the appointed executor will oversee the estate distribution. If there is no will, state laws will determine how assets are distributed through intestate succession.

Probate Process:

-

Submit the will to the probate court (if applicable).

-

Inventory all assets and liabilities.

-

Settle debts and distribute remaining assets according to the will or state law.

-

Close the estate once all obligations are met.

6. Transfer or Close Accounts

-

Joint Accounts: If you were a joint account holder, you may have immediate access.

-

Individual Accounts: These may require probate before they can be accessed or closed.

-

Investment and Retirement Accounts: Contact financial institutions to determine beneficiary designations and transfer procedures.

-

Subscription Services & Utilities: Cancel services such as phone plans, streaming subscriptions, and utilities.

7. Claim Life Insurance and Pension Benefits

Life insurance policies can provide financial relief for surviving family members. Contact the insurance provider to file a claim, providing necessary documents such as the death certificate and policy details.

8. Manage Property and Real Estate

If the deceased owned real estate, decide whether to:

-

Sell the property: Proceed with a legal transfer and sale process.

-

Transfer ownership to heirs: Complete necessary documentation and legal proceedings.

-

Rent the property: If applicable, update lease agreements and property management details.

9. File Final Tax Returns

The IRS requires a final tax return to be filed for the deceased.

Key Tax Considerations:

-

Income taxes for the year of death

-

Estate taxes if the estate exceeds the exemption limit ($12.92 million in 2023)

-

Capital gains taxes on inherited assets

10. Seek Professional Assistance

Managing a deceased loved one’s finances can be complex. Seeking help from professionals such as:

-

Estate attorneys for legal guidance

-

Financial advisors for investment and asset management

-

Certified public accountants (CPAs) for tax-related matters

Conclusion

Dealing with a loved one’s finances after their passing requires careful attention and organization. By following these steps—obtaining the death certificate, notifying relevant institutions, settling debts, handling probate, and transferring assets—you can navigate the process with confidence. If you need assistance, consulting with legal and financial professionals can ease the burden and ensure everything is handled correctly.